Tinubu Rolls Out Personal Income Tax Calculator to Show Nigerians Real Savings Under New Tax Law

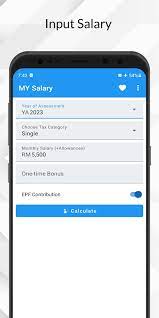

President Bola Tinubu has unveiled a Personal Income Tax Calculator, a digital tool designed to help Nigerians understand how much they could save under the new tax regime scheduled for implementation in January 2026. The calculator is accessible on the government’s tax reform portal, fiscalreforms.ng, and allows users to directly compare their current tax obligations with what the new law would require.pmnewsnigeria.comNaija News

Announcing the launch via his official X (formerly Twitter) account, Tinubu explained, “A fair tax system must never punish poverty or weigh down the most vulnerable. With the new tax laws … we have lifted this burden and created a path of equity, fairness, and true redistribution in our economy.” He urged Nigerians to try the calculator, noting that it clearly shows how low-income earners are protected, compliance is simplified, and transparency is strengthened.pmnewsnigeria.com

The calculator reflects the broader objective of the Renewed Hope Agenda, to modernize Nigeria’s fiscal landscape while centering equity and inclusivity. It comes into play amid sweeping tax reforms enacted earlier this year, which include the consolidation of tax statutes, restructuring of the revenue agency into the Nigeria Revenue Service (NRS), and the introduction of progressive new tax bands.WikipediaReutersPunch

Key highlights of the tax reform include:

- Zero tax on individuals earning ₦800,000 or less annually, a move aimed at easing the burden on the most vulnerable groups.Business Elites AfricaReuters

- A progressive tax structure ranging from 15% to 25% on higher income tiers, designed to distribute tax responsibility more fairly.dropazz.comBusiness Elites Africa

- Systemic overhaul: replaced FIRS with NRS, introduced uniform tax administration, and eliminated redundant taxes, all in a bid to simplify and streamline the system.It’s AmericaWikipedia

Economists and fiscal watchdogs have welcomed the calculator, viewing it as a transparent tool to empower individuals and build trust in the reforms, especially amid public calls for clarity and fairness.The Nation Newspaper

Looking ahead, the calculator is expected to become central to tax awareness campaigns. It promises to demystify what can often be an opaque process, allowing citizens to see the tangible impact of policy in real time, making projection of take-home pay more accurate and decisions around savings, investments, or financial planning easier.